A private equity firm called SKKY Partners was established in 2022 by Kim Kardashian, who is well-known for her prosperous commercial endeavors in the fields of fashion, pop culture, and beauty. Jay Sammons, a former executive at Carlyle Group, was also a co-founder of the company. By capitalizing on Kardashian’s prominent brand, name recognition, and financial acumen, the company has set an ambitious aim of raising one billion dollars to invest in businesses that are driven by consumers.

Nevertheless, recent events suggest that SKKY Partners has been confronted with considerable obstacles in its efforts to raise funds, which has resulted in Kim Kardashian being kicked out of her position as managing partner without any formalities.

Kris Jenner, Kim Kardashian’s mother, has been completely removed from the SKKY Partners and is no longer employed by the company. This is additionally the case. The website had previously referred to her as a “senior advisor” before the elimination of that designation.

The Obstacles Facing Fundraising

SKKY Partners has had a difficult time meeting its fundraising goals, despite the initial euphoria that surrounded the alliance between Kim Kardashian and the company. As of March 2024, SKKY Partners had only obtained capital commitments totaling 121 million dollars, which was a very small portion of the one billion dollar objective it had set for itself. A number of variables have been cited as the source of this shortage, one of which being a decrease in interest from other investors in consumer-focused private equity, particularly in a fundraising environment that has become more lenient as a result of high interest rates established by the Federal Reserve.

An investment in Truff, a manufacturer of truffle-infused hot sauces, with a minority stake valued at around $250 million, was one of the modest successes that the company has achieved up to this point. In November of 2023, SKKY Partners made the announcement regarding the investment.

“Primary focus is on identifying culturally relevant brands that forge deep emotional connections with their target consumers and offer those consumers coveted products and services,” SKKY stated in a press statement. “This is the primary focus of the company.”

SKKY Partners, on the other hand, has had difficulty acquiring more investment transactions after this initial investment, which has caused onlookers to express concern regarding the company’s strategy and execution in the highly competitive private equity atmosphere.

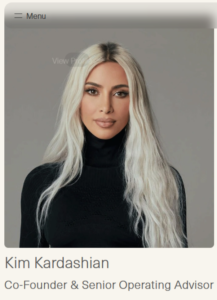

The Reclassification of Kim Kardashian

Kim Kardashian has been secretly demoted from her role as managing partner at SKKY Partners to that of “senior operating advisor” as a result of the issues around funding and the lack of deal making that has occurred. As a result of the fact that her initial role “did not align with her strengths,” various sources have reported that this decision was mutually agreed upon. Due to the fact that her celebrity status and business acumen did not translate into the nitty gritty of financial deal structuring and fundraising the capital required to make enormous, risky bets on consumer brands, Kardashian encountered difficulties in the realm of private equity fundraising. This was despite the fact that she had extensive working experience in the business world.

Although Kardashian’s brand name carries a significant amount of value, sources within the company have pointed out that it was not enough to meet the ambitious fundraising targets that were set by SKKY Partners. Furthermore, she was unable to fully engage in the rigorous requirements of private equity fundraising due to her busy schedule, which included frequent travel as well as multiple commitments to the media and business as well.

repercussions for SKKY Partners and Partners

The difficulties that even high-profile individuals face when transitioning into specialized financial sectors such as private equity are brought to light by the decision to demote Kardashian and the difficulties that the company has had in raising funds. The presumption that the influence of celebrities can effortlessly attract substantial investment has been called into question, highlighting the importance of field-specific expertise and networks in the process of successful fundraising.

There is an immediate concern for SKKY Partners, which is to reevaluate its operational focus and fundraising strategies. It may be necessary for the company to adjust its strategy, which may involve the search for partners who have more extensive experience in private equity fundraising or the investigation of alternative investment strategies that are more closely aligned with the capabilities of the company’s leading team.

View this post on Instagram

Attempts That Kim Kardashian Will Make in the Future

Kim Kardashian is focused on her other business endeavors, despite the fact that she has resigned from her position as a manager at SKKY Partners. She continues to enjoy a great deal of success with her shapewear brand, SKIMS, which is currently valued at $4 billion. A further indication of her unwavering dedication to the beauty industry is the fact that she has been promoting her beauty line, SKKN, and has hinted at the launch of a new cosmetics line.

Her plans to take the California bar exam have been delayed until 2026 due to the fact that she has a very busy schedule. Kardashian is also working toward a career in the legal field. Her most recent acting endeavors, which include a role in “American Horror Story: Delicate,” have garnered praise, demonstrating her versatility in an effort to break away from her typical business endeavors and expand her horizons.